Life & Work After 60… Broader Possibilities Ahead

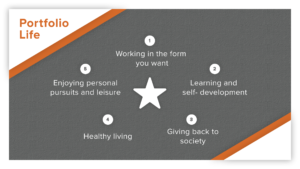

This month, January 2019, begins a six part series about life and work after age sixty. This series is for those who want to create a thoughtfully crafted future that is best described as a portfolio life. The five elements of a portfolio life include working in the form you want, learning and self-development, giving back, healthy living, and enjoying personal pursuits and leisure.

Over the past thirty years in my career transition practice, most of my clients in their 40s, 50s and 60s have been very interested in one day living a portfolio life. Many have already done so successfully. In this blog I will describe this life and ask you, as I have asked each of my clients, “When the time is right, is this how you would like to live in the second half of your life?” I am betting you will.

Irish economist Charles Handy coined the phrase “portfolio life” in his 1989 book, The Age of Unreason. Handy describes this life as “A portfolio of activities – some we do for money, some for interest, some for pleasure, some for a cause…the different bits fit together to form a balanced whole…greater than the parts.” I will get to this second half of life destination in a minute, but first let’s take a look at what precedes it.

The Learning Years

The first quarter of life (childhood to young adulthood)

In our first twenty-five years, the majority of our time is spent learning in school, on the playground, in our families and neighborhoods, and in the organizations we occupy. We learn how to do what we need and want to do, and how to navigate our world.

The Earning Years

The second quarter of life (young adulthood to middle age)

In this phase, in addition to our personal and community commitments, most of us choose to establish ourselves in our paid work. We spend more time at this than all other areas of our lives, and want to establish ourselves as competent and successful. If we are highly ambitious in our careers, over 70% of our time and energy will be invested in our paid work.

The Portfolio Years

The third and fourth quarter of life (big changes that begin in our 50’s or 60’s)

The earning years usually continue without much change early in this period, but over time, can take on many forms. For most of us, getting out of the workforce altogether is not economically feasible or wise until sometime in our 60s. Economics editor Chris Farrell’s book Unretirement makes a strong financial, personal and societal impact case for working longer and retiring later.

It is difficult to leave your career early, not only because of financial needs and longer life expectancy, but also because our identity, social circles and sense of purpose are tied closely to our working role and organization. Letting go of a significant job without a predictable alternative income source or a compelling new work identity, can be very difficult. Proceed with caution, but start exploring options before the big changes take place. Start building your bridge now before you need it.

Understanding the many ways you can work in the form you want in the second half can ease the disruption of leaving your job and can include a wide range of options. There include using your existing skills in a new environment, pursuing new terms of employment (like consulting, contracting, part-time or interim assignments), starting a new venture, downshifting to a lower level role, new work altogether, or a plan to bridge from one of these options to another over time. You have many more choices than you might realize.

To learn more about these options, read my 2018 blog series. Each of nine distinct career alternatives is described, along with financial implications, degree of difficulty, success strategies and case studies. Keep an open mind, experiment a little, and have some conversations with people who have already pursued these new avenues. You might be surprised by what you discover!

Over time, as earning a full-time wage becomes less of a primary driver, other aspects of our lives grow in importance. More time is available to broaden and enrich our lives. The five part portfolio life model is described in the writings of David Corbett, author of, Portfolio Life, the New Path To Work, Purpose and Passion after 50. I highly recommend this book to executives and professionals considering a portfolio life.

In the early stages, the learning and self-development elements of a portfolio life might still have a professional focus. On the other hand, when the time is right, you might prefer to do something altogether different from what has been your professional focus. If so, consider programs within universities, community education, and other learning options such as Road Scholar (previously Elderhostel).

Start thinking of yourself as a college freshman, but this time you don’t need to choose a practical major. Is it time to experience liberal arts learning with this liberating twist? Is there something you have been hoping to learn and/or develop, but you haven’t had the time? Is it time now?

Giving back to society becomes a growing focus of a portfolio life. More of your time, talent and resources can now be directed towards the programs you care about. What has worked for you in the past, and what hasn’t? Sit down with someone who has set a good example of being generous in this way and has similar community interests and values to yours. Discuss your options and ask their advice on how to find a path that might fit you. Who needs you now? What cause do you want to serve that will energize you?

Healthy living includes several personal aspects of a portfolio life, such as mind, body and spiritual work, strengthening relationships with family and friends, and managing your finances. Is it time for that fitness class? That bike ride? Are you satisfied with your financial health? What are you reading these days? How are you taking care of yourself? Do you have a spiritual practice? There are many good resources and people out there to tap for ideas. It is time to take stock and begin those conversations about your health, finances, relationships and overall well being.

At one time enjoying personal pursuits and leisure was the principal dream of retirement and second half living. I suspect it is still that for many. Ameriprise Financial did a study of retirees a few years ago, and found 20% of their retired subjects considered themselves “carefree contents.” Another 20% identified more fully with the term “empowered reinventers.”

There are many personal and leisure pursuits that will bring us satisfaction in our portfolio years, but if you are still reading this blog, It is likely you appreciate the value of all five portfolio life elements. You aren’t exclusively pursuing “carefree content” living in your second half. Personal pursuits and leisure are not enough to sustain you, but they are important. What are the activities that you enjoy?

Summary, and what lies ahead in this blog series

Is a portfolio life the story you would like to write in your second half? It may take a while before you can jump off the full-time job track and fully embrace a portfolio life, but I think you will agree that this is a very appealing choice.

Perhaps your portfolio life will include some version of the five part model I have described in this blog. You will learn about each of these five elements in the coming months, with case studies and guidance to help you shape your path forward.

Even if a portfolio life is a ways off for you, it’s not too early to start building a bridge to it. Perhaps it is time to start letting go of some work related activities. You might also want to start adding other elements you haven’t attended to recently, or which your work has displaced. We are always moving towards a new life stage. Good luck as you start your next chapter.